Medicare Part D provides prescription drug coverage. Part D is offered through private third-party companies. While the Centers for Medicare and Medicaid Services (CMS) regulate these plans, each plan has its own list of covered drugs and participating pharmacies. There is a tool on the Medicare.gov website where you can enter your prescription drugs and the website will provide you with a list of plans that will provide you with the best coverage.

Those who join a Part D plan will have to pay a monthly premium as well as any deductibles, co-payments, or co-insurance that their plan requires. People with low income may be eligible for help covering these costs (see below). Part D is a voluntary benefit, although there may be a penalty for late enrollment.

Part D Coverage Gap – The Donut Hole

Part D has a very significant coverage gap in which a drug plan’s ordinary coverage does not apply. Rather, the consumer is responsible for a significant portion of the costs. This gap in coverage is commonly referred to as the donut hole. In 2015, the coverage gap begins once a consumer incurs drug costs of $2,960, and continues until he/she has spent $4,550 in total out-of-pocket costs (this includes any deductibles, co-payments, or coinsurance paid while reaching the coverage gap).

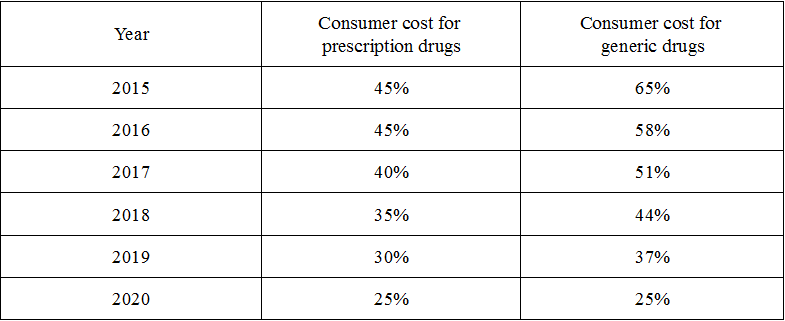

People in the coverage gap pay 65% of the cost of generic drugs and 45% of the cost of brand name drugs. Although the consumer only pays 45% of the cost of brand name drugs, the entire price of the drugs counts as out-of-pocket spending towards getting out of the coverage gap. In the coming years, Medicare will phase in additional discounts on both brand name and generic drugs. By 2020, there will be flat 25% co-payment for both brand name and generic drugs.

The following is a chart detailing the declining costs for a consumer in the coverage gap over the coming years:

EPIC and Extra Help – Assistance for Low Income Enrollees

Low income New Yorkers may be eligible to receive prescription drug coverage from the Elderly Pharmaceutical Insurance Coverage program (EPIC) through New York State or “Extra Help” for Medicare Part D from the Social Security Administration. These programs help provide coverage in the gap left by ordinary Part D plans and can also reduce or eliminate deductibles and co-pays. People with full Extra Help will not pay a monthly premium for their Part D as long as they choose a plan that meets certain requirements that Medicare calls a “benchmark” plan.

Enrollment for Part D

When initially enrolling in Medicare you are given the opportunity to enroll in a Medicare Advantage (Part C) and/or Part D plan. Subsequently, every year you have the opportunity to make changes in your Medicare between October 15 and December 7. This period is called “Open Enrollment”. Additionally, between January 1 and February 14 you can disenroll from a Medicare Advantage plan and switch to Original Medicare. If you choose to do this, you have until February 14 to enroll in a Part D (prescription drug) plan.